Maximize Your Tax Savings with Our Section 179 Calculator

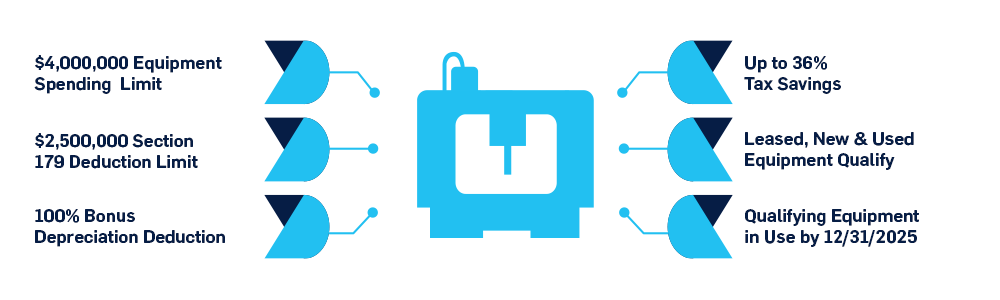

Investing in new equipment can significantly benefit your business, and understanding the tax implications is crucial. Our Section 179 Tax Calculator helps you estimate potential tax deductions for qualifying equipment purchases, enabling you to make informed financial decisions.

Companies should consult their tax accountants to confirm eligibility for tax benefits.

If a company exceeds its depreciation limit for the year, Ellison Financing Services can also offer a number of financial products to minimize a company's tax liability beyond Section 179, and Standard Depreciation.

Ellison Financing Services would be happy to finance your equipment purchases and answer any questions relating to this tax law. Please feel free to contact us with any questions.