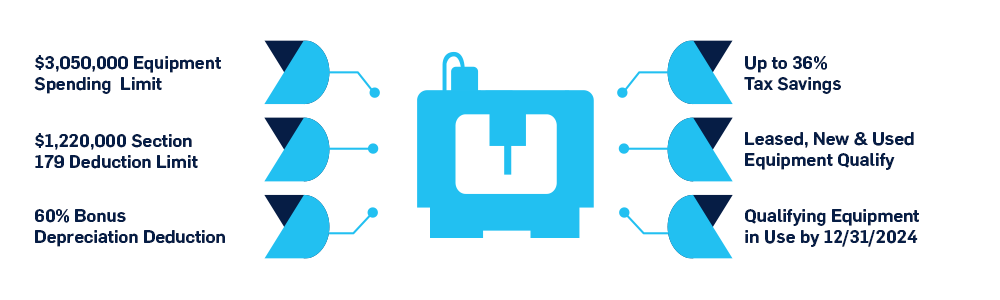

Enhanced tax incentives are available when you purchase equipment in 2024!

MFS will show you how investing in equipment NOW can pay off in BIG Tax Savings for the Year 2024.

Section 179 Tax Savings

Section 179 Tax Savings

Boost your manufacturing capabilities and take advantage of the biggest tax incentives of the year!

Now is the best time to MAKE MORE for your future.

» 60% of Equipment Purchased and Put in Service in 2024 is Tax-Deductible

» Increased Deductible = Increased Savings

Companies should consult their tax accountants to confirm eligibility for tax benefits.

If a company exceeds its depreciation limit for the year, MFS can also offer a number of financial products to minimize a company's tax liability beyond Section 179, and Standard Depreciation.

Manufacturers Financing Services would be happy to finance your equipment purchases

and answer any questions relating to this tax law. Please feel free to contact us with any questions.

Contact your MFS Expert: Darryl Schoen (562) 949-4771, ext. 2516